Gillian Chepchirchir Moindi

8

min read

Building Business and Navigating Uncertainty

Simon Webster

Guest Lecturer | London Business School, Cambridge University

Key Highlights

Simon Webster is an entrepreneur and an investor. He is also a Guest Lecturer at the London Business School and University of Cambridge, Judge Business School, and he is an Entrepreneur in Residence at INSEAD. Making a few recommendations, he sheds light on the value of diversity and cultivating the right operational mindset.

He delves into the two-fold conversation on ETA, buying and managing business, and the nuanced skills that will support the new CEO as they navigate succession issues, equity depreciation, building capital, and finding the discerning investor base required.

At the core of building a business, Simon advises that the successful CEO is risk averse, learns from local and international investors, researches their background, and builds leadership capacity among subordinates.

Simon's career was off to an auspicious start. He was fortunate enough to land a job at IBM, becoming the UK Account Manager for six international banks. But he did not feel comfortable in a large organisation and he wanted to scratch his entrepreneurial itch by joining a smaller company where he would see the result of his efforts more clearly.

To learn more about business, he embarked on an MBA at the London Business School (LBS). At LBS, he heard of a new concept, “search funds.” He went on exchange to Columbia Business School, where he tracked down some of the early search fund entrepreneurs or entrepreneurship through acquisition (ETA), who piqued his interest in owning and running a business straight from an MBA programme.

The model was still at an early stage in the United States. Despite that, a few names like Irv Grousebeck (who is credited with developing the model), Rob Johnson (investor), Kirk Reidinger and Jamie Turner (entrepreneurs) were early adopters of the model, creating awareness and testing its efficacy.

Drawing on a case study of the pioneers and the mentorship of Rob Johnson, Simon saw an opportunity to pivot to entrepreneurship through acquisition, becoming only the fifth person in the world to undertake what is now well-known as a traditional search fund.

Launching his search fund in the UK made it crystal clear that the general unfamiliarity was going to be perilous to garnering local investors. He was able to convince several investors on the idea of owning part of an operational venture, affording him the traction he needed to deliver stakeholder value.

Simon’s zeal for understanding the duality of searching for, buying and then operating a business was nuanced by a tough 6-months of work raising money for the search and 3.5 years of searching to finalize the acquisition of a company before he was able to realise his dream of becoming the CEO of his own company. Then followed a rapid and steep learning curve as he became CEO of RSL (subsequently RSL Steeper.

He was the CEO for 10 years, and as part of the sale, he stayed for an additional two years. In that period, he grew the business by a factor of 10x, growing revenue from £3m to £30m and employees from 40 to 450. Needless to say, he delivered great returns for his investors and realised capital from his equity stake in the venture

Following the sale of RSL Steeper, Simon has used his learning to actively lead and contribute to the acquisitions and operations of more than 25 companies. He has mentored and invested in many search fund entrepreneurs as they, too, have become CEO at a young age. His business acumen, experience and fortitude through adversity have made him one of the most respected members of the ETA space.

Much has changed since he took his leap of faith. The success of the model has led to formal teaching of ETA at business schools, and success stories have inspired young entrepreneurs and investors to move into ETA. But, if being in the industry for that long had taught him one thing, it is the unique nature and complex subtlety of ETA and the time and patience it takes to become an adept ETA CEO and a successful ETA investor.

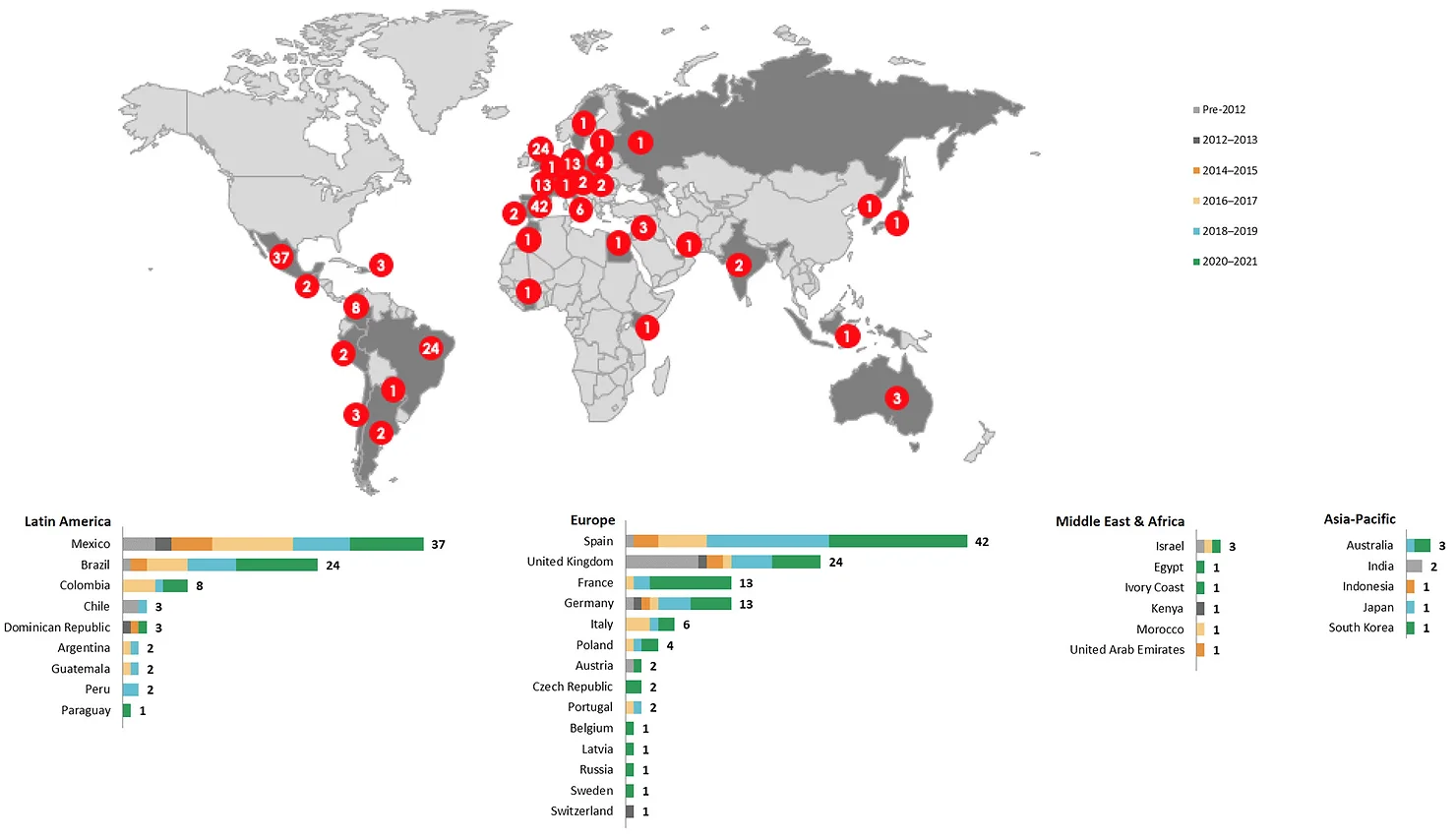

During the 1990s and 2000s, the model spread in the US and started to be taught at the leading business schools. During this time, in Europe, business schools taught only the very basics of search funds, if they taught it at all. This had an impact on the low number of search funds undertaken in Europe. If students did not learn about search funds at business school, they did not see it as a career option. Similarly, investors could not invest if there were no entrepreneurs to invest in.

International Search Funds by Region, Country, and Year of Formation (Kolarova et al., 2023)

Based on his knowledge of the growth in ETA in the United States, he knew that there was an opportunity to expand search funds in Europe.

To fill that void, he honed his teaching and mentorship skills by engaging with business schools and especially the student clubs. This created awareness, and IESE, where Rob Johnson was teaching, engaged more fully and established the IESE Search Fund Centre.

As Simon continued to visit business schools, he arranged panel sessions with various successful proponents of the model. This led to more entrepreneurs choosing entrepreneurship through acquisition as a career. Thus, after ‘teaching’ informally for five years, his tenacity was rewarded with an invitation and privilege of lecturing at the University of Cambridge's Judge Business School and the London Business School. Simon is also a member of INSEAD's entrepreneurship in residence cohort, where he mentors students who are considering an ETA career.

Entrepreneurship Through Acquisition

The “search fund” was first mentioned in Irving Grousbeck’s lecture at Harvard in the early '80s (Dennis & Laseca, 2016). With the model came the possibility of owning an established business by simply buying it, revolutionizing ways of thinking about entrepreneurship and investment.

“I did my MBA between 89 and 91. I learned about search funds from Rob Johnson while I was at business school. And he said to me, have you ever considered buying a business? And I thought, how on earth will I do that?”

Learning the fundamentals at that time meant Simon, serendipitously, was among the very first to get a glimpse of the idea. He has experienced both sides of the equation: the building and buying aspects of search companies. So, he delves into initiating beginners to search, becoming the ultimate CEO, and the transition to investing and mentorship.

Initiating Beginners to ETA

Simon’s business acumen sold him on the idea that “buying a venture” was a lower risk and better suited to his talents than the traditional entrepreneurship route of starting a business. But in the three years that he “searched,” he realized having knowledge of running a company and one’s industry was only part of the equation. Thus, it was not just about crunching numbers but being persuasive enough to close a deal.

“I suspect a lot of successful search fund CEOs would say they're not good searchers because it's a skill set separate from running a business. But when one meets vendors and does a deal, it's the soft skills that determine success.”

Starting in ETA, individuals make mistakes that see them backtrack and re-strategize, and c 25% do not acquire a company. However, Simon points out that beginners can spend less time going back to the drawing board if, from the onset, they develop a clear vision of their preferred industry/s and the business characteristics that appeal to them; they will maxmise their chances of success.

“Diversity significantly improves financial performance when one measures profitable investments at the individual portfolio-company level and overall fund returns.” (Gompers & Kovvali, 2018)

In a study conducted on the Venture Capital (VC) segment, Gomper & Kovvali (2018) highlight that diversity not only shapes innovation but also informs productive capital management. Based on the same argument, Simon calls on enthusiasts to explore several information sources, such as experienced local investors, industry reports, and potential vendors, to make more meaningful strategic decisions, especially when starting their investment journeys.

The Making of a CEO

The succession problem is one of the most pertinent concerns in the “buying a business” model. When such acquisitions finalize, founding CEOs leave systems and people that they have developed or worked with over many years. It often becomes challenging for new CEOs to adapt, especially when they are unfamiliar with industry trends, the people and the nature of a company’s business. The analogy often referred to is a new jockey taking the reins race.

From Simon’s experience, the greater the knowledge of a company and sector will help a new CEO integrate into a company’s culture with reduced turbulence. However, it is imperative for them to anticipate and expect adversity. Bad and unexpected events are inevitable in a small business. How the entrepreneur responds is key. To tilt the scales in the direction of both the entrepreneur and investor, a traditional search fund CEO will select a company with defensive characteristics (profitable, growing and cash generative) and be intelligent, well educated, and motivated but also have the humility to listen hard to investors from a diverse geographical and business background in order to develop agile responses in the face of adversity.

However, he encourages that with time, the new CEO will start to get a 'feel' of what is happening around them in the business and learn how to channel their contributions into places where they are more meaningful. Similarly, their impact on the business culture of the business they have acquired will increase as their influence grows and the influence of the founding CEOs recedes.

“The organizational culture is an extension of the founding CEO’s style, personality, and preferences. From the onset, employees, customers, and business partners identify start-ups with their founders, who take great pride in their founder-cum-CEO status.” (Wasserman, 2014)

Building a company takes an immense amount of energy and commitment. When founders sell their ventures, they often have reservations about radical transformations that a new CEO will implement following an acquisition. In a traditional search fund, one of the key criteria is for the business to be a profitable, cash-generative business. This reduces risk for a rooky CEO and their investors alike.

A CEO’s highest calling Is mentoring subordinates and building leadership capacity among them. This nurtures the next wave of leaders skilled in the fiscal as well as the operational aspects of business. Thus supporting innovation, adaptability and performance.

Conclusion

With the only prerequisites being management skills, grit and determination, and the ability to have or raise sufficient financial capital, a young entrepreneur in their early 30s can be at the helm of a company. But being a CEO is no walk in the park. Succession issues, poor cultural fit, underwhelming after-sale rewards, and waves of uncertainty, just to name a few, are the constant struggles that one must endure and adapt to. Thus, as the world becomes more globally connected, it takes risk aversion, a tenacious attitude, proactive learning, energy and a tremendous amount of research, locally and internationally, to be a responsive CEO.

References

Dennis, J., & Laseca, E. (2016, November 7). Entrepreneurship through Acquisition: Origin and History. The evolution of entrepreneurship through acquisition. University of Chicago, Booth School of Business. https://polsky.uchicago.edu/wp-content/uploads/2018/03/Booth-Research-Evolution-of-ETA_FA110716.pdf

Gompers, P., & Kovvali, S. (2018, July 9). Finally, Evidence that Diversity Improves Financial Performance. Harvard Business Review. https://hbr.org/2018/07/the-other-diversity-dividend

Kolarova, L., Johnson, R., Simon, J., & Kelly, P. (2023, January 19). Search funds continue to go global. IESE Insight. https://www.iese.edu/insight/articles/search-funds-continue-to-go-global/

Wasserman, N. (2014, August 11). The Founder's Dilemma. Harvard Business Review. https://hbr.org/2008/02/the-founders-dilemma